GERMAN CONSUMER LENDING MARKET – Battleground, paradise or the place to be

Banks across Europe have fought significant battles to cope with new economic and regulatory conditions as well as changing customer requirements and demands in recent years. The Covid-19 crisis, zero interest rate world, platform economy, new competitors and declining profit margins in almost all relevant business segments are just some examples of the major challenges.

One of the new niche stars and among the business segments least affected by all these challenges is the consumer lending market. Growth figures point straight north and consumer lending appetite in Germany seems to be very high. Nonetheless, competition in this market is rising and numerous players – not only traditional banks – have recently recognized the high relevance and profit potential of this market segment.

„If you don’t drive your business, you will be driven out of business.“

Charles Bertie Forbes, Journalist and Author

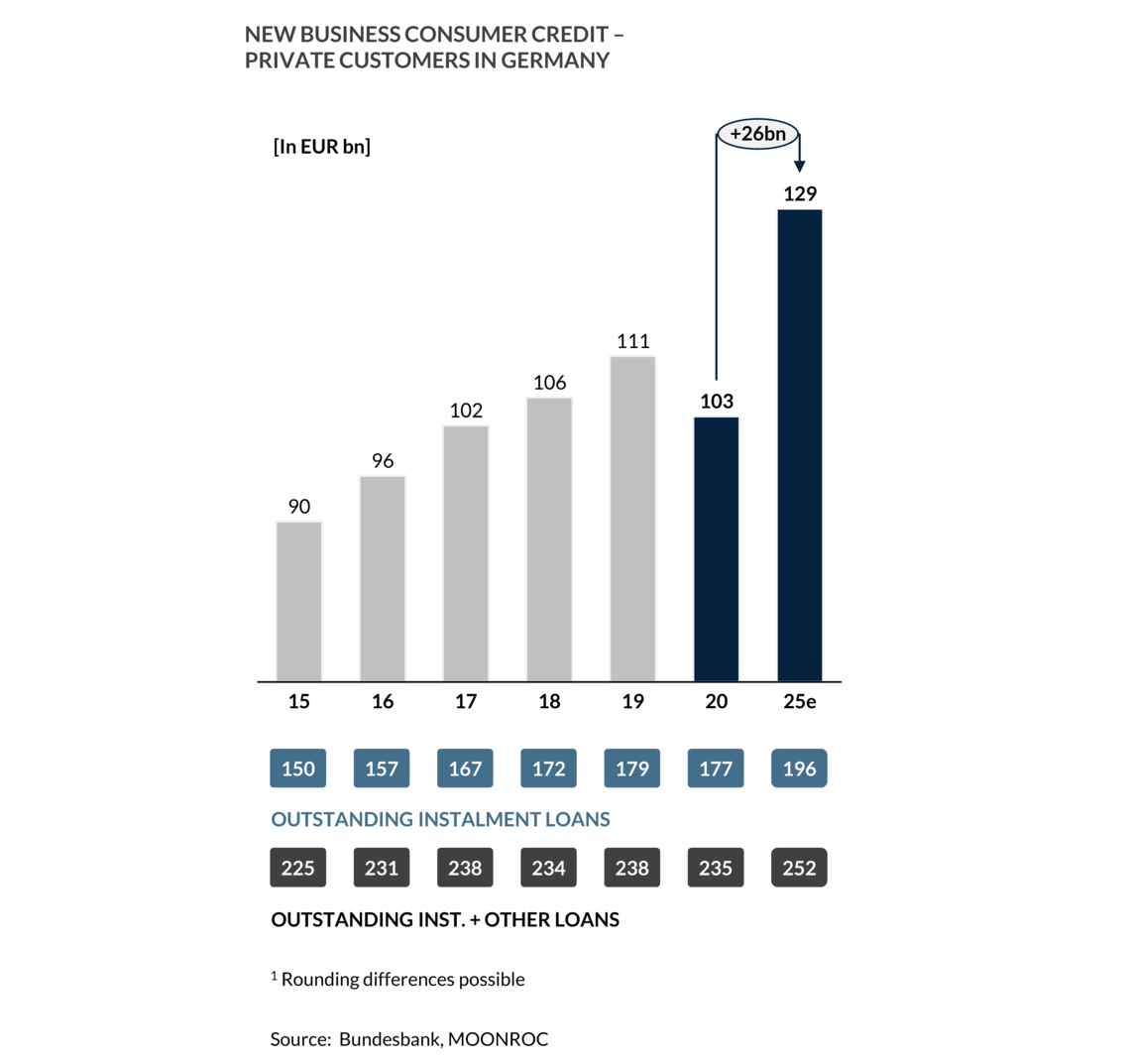

Being Europe’s largest economy, Germany offers a promising market environment with an extraordinary repayment behaviour and a high level of financial resources. However, in relation to the size of the overall German economy, the German consumer lending market is still relatively small with a volume of outstanding instalment loans of EUR 177bn in 2020. New business volume is around 103bn EUR. This means that there remains considerable room for growth. Given current market circumstances and growth rates, we expect new business volume of consumer credit to grow by 26bn EUR and reach EUR 129bn by 2025.

The market landscape is changing, and the Covid-19 pandemic has further increased the importance of online channels in the consumer lending market. Thus, new technological developments create opportunities for new players and as a consequence, new challenges for established banks arise. In this article, we showcase 5 of the most relevant trends in the German consumer lending market and explore the opportunities for traditional institutions.

We have analyzed the current state of the German consumer lending market, the most important trends of this market and the resulting implications for banks and other financial institutions.

In this article, we discuss/show possible winning strategies for banks based on the five most relevant developments in the consumer credit market.